- Q&A: Unveiling the Financial Perks of ESG Training in 2025

- Connecting Themes: Weaving ESG into the Corporate Fabric

- Supporting Resources & Examples: Practical ESG Implementation

- Conclusion & Key Takeaways: ESG Training as a Catalyst for Financial Success

- FAQs: Decoding ESG Training and its Impact

- Quick Summary: Maximizing Your Company’s Bottom Line with ESG Training

ESG (Environmental, Social, and Governance) factors have become increasingly crucial for businesses in 2025. Understanding how ESG training benefits your company can lead to significant improvements in your bottom line. This article explores the multifaceted ways in which corporate ESG education contributes to financial success, offering insights into achieving a strong sustainability training ROI.

Q&A: Unveiling the Financial Perks of ESG Training in 2025

This section dives into the specific ways ESG training can enhance your company’s financial performance in 2025, incorporating keywords such as ESG courses, ESG certification courses, and ESG online course options.

Q: What specific financial benefits can companies expect from investing in ESG training programs?

A: Investing in ESG training programs offers several tangible financial advantages:

- Enhanced Brand Reputation: Companies prioritizing sustainability are viewed favorably by consumers, investors, and partners. According to a Nielsen report, 73% of global consumers say they would change their consumption habits to reduce environmental impact. Effective training equips employees to implement and communicate these initiatives effectively, enhancing brand loyalty and public trust. For example, by implementing robust ESG reporting practices, companies can showcase their dedication to sustainability and attract environmentally-conscious consumers.

- Operational Efficiency: ESG training can drive operational efficiency by reducing waste and optimizing resource use. McKinsey research found that executing ESG plans effectively can impact operating profits by as much as 60% by combating rising operating costs. By choosing energy-efficient equipment, companies make big strides for both the environment and their bottom line.

- Talent Acquisition and Retention: A strong ESG proposition helps companies attract and retain quality employees. Companies with robust ESG strategies experience 25% lower turnover among millennial employees, helping reduce recruitment costs and increasing workforce stability. Companies with strong ESG strategies experience 25% lower turnover among millennial employees, helping reduce recruitment costs and increase workforce stability. Integrating ESG policies can also result in up to a 50% increase in employee turnover, improving productivity levels.

- Improved Financial Performance: ESG initiatives improve overall financial performance by reducing energy bills, operating costs, and other expenses. Sixty-two percent of respondents to a Capgemini survey said anticipated cost savings were a factor in their organization’s sustainability investments. Companies that proactively integrate ESG into their business models enhance risk management, attract investment, and improve long-term profitability.

Q: How does ESG reporting training contribute to a company’s financial health?

A: ESG reporting training is essential for building stakeholder trust and demonstrating a company’s commitment to sustainability. Benefits include:

- Enhanced Stakeholder Trust: Transparent ESG reporting aligns company actions with stakeholder expectations, fostering trust, engagement, and loyalty. By understanding the importance of sustainability reporting, companies can better communicate their ESG efforts to stakeholders and build stronger relationships.

- Improved Risk Management: By strengthening risk management, improving operational efficiency, and enhancing financial resilience, ESG reporting drives long-term value creation. Companies that stay compliant with ESG-related regulations also have less exposure to fines, penalties, and other business risks, which positively affects their bottom line.

- Increased Market Value: A higher ESG score was associated with up to a 1.2x increase in EV/EBITDA, while an improvement in ESG score can lead to up to a 1.8x increase. This illustrates the financial advantages of improving ESG performance through targeted training and strategic initiatives.

Q: What role does business sustainability training play in improving a company’s bottom line?

A: Business sustainability training equips employees with the knowledge to integrate sustainability principles into decision-making processes, positively impacting the bottom line:

- Competitive Advantages: Companies with successful ESG programs improve their market position and brand strength compared with competitors. In a March 2025 Capgemini Research Institute survey, 82% of 984 senior executives in 12 countries cited potential higher sales as a driver of sustainability investments in their company. In today’s fast-evolving business landscape, sustainability is no longer a buzzword — it’s a strategic imperative.

- Customer Loyalty: Companies adhering to ESG principles more easily attract and retain customers who apply ESG considerations in buying decisions. In an online survey conducted in March 2025 by advisory services firm GlobeScan, 49% of 1,004 U.S. consumers said they had bought an environmentally friendly product in the past month, while another 36% would have liked to if they could have — data points that show many consumers do care about ESG issues.

- Innovation and Market Share: Diverse management teams deliver 19% higher revenues from innovation compared to less diverse company leadership. A visible commitment to ESG can also help companies attract and retain top talent, supporting workforce management and overall business performance. This shows that business sustainability is not only beneficial for the planet, but also improves the bottom line.

Q: How can ESG compliance training help companies avoid financial risks and penalties?

A: ESG compliance training ensures that companies adhere to ESG-related regulations, reducing exposure to fines, penalties, and other business risks:

- Reduced Legal Risks: Companies staying compliant with ESG-related regulations face fewer fines, penalties, and other business risks, positively affecting their bottom line. Non-compliance risks include financial penalties and reputational damage. Ensuring compliance with workplace safety regulations and standards

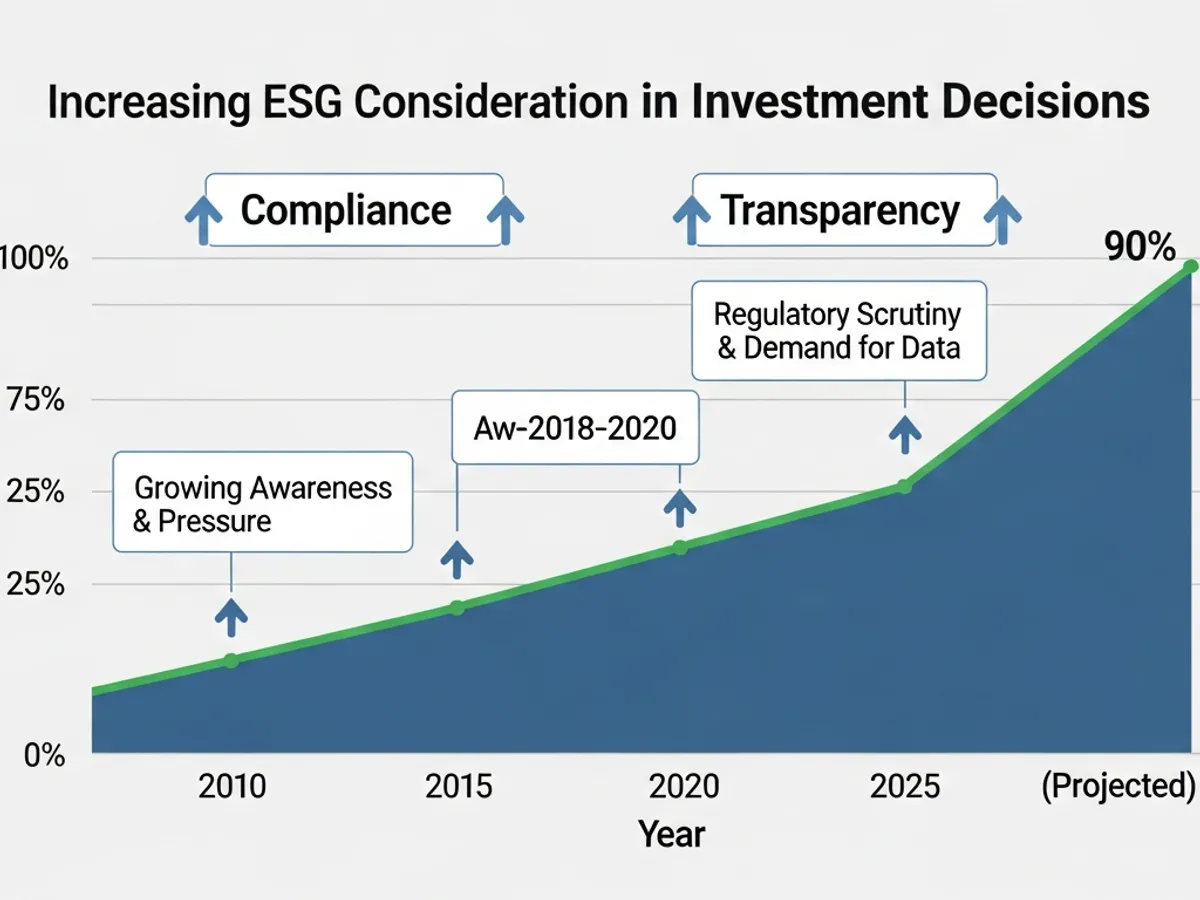

Implement safety training and reporting systems to prevent accidents and incidents. - Improved Investor Confidence: Investors increasingly consider ESG factors in their investment decisions. Bloomberg predicts that global ESG assets and investments will exceed $50 trillion by 2025. Integrating ESG investing trends into business practices can attract investors and drive financial growth.

- Enhanced Brand Resilience: Strong ESG practices enhance brand resilience, helping companies weather market fluctuations and maintain long-term profitability. Companies with strong ESG practices are fostering not only loyal customers through improved brand image but also a more engaged workforce.

Q: What are the benefits of leadership ESG training in driving financial performance?

A: Leadership ESG training is crucial for integrating ESG principles into a company’s strategic vision and ensuring that sustainability initiatives align with overall business goals:

- Strategic Alignment: Successfully implementing ESG strategies hinges on fostering alignment across business leaders, scientists, and policymakers. Learning how to bridge that gap and work with all three groups is a central focus.

- Improved Decision-Making: Educating leaders in ESG deepens their understanding of critical issues shaping the business world, enabling them to integrate ESG principles into decision-making processes. This course provides a comprehensive exploration of each ESG aspect and meticulously examines how these principles influence a company’s performance and stakeholder relations.

- Enhanced Stakeholder Engagement: Leaders who champion ESG initiatives can effectively communicate the company’s commitment to sustainability, enhancing engagement with employees, customers, and investors. Communicate and educate regularly communicate the importance of ESG goals and how they align with the company’s mission.

Q: How does employee ESG education contribute to a company’s financial success?

A: Employee ESG education fosters a culture of sustainability within the organization, driving innovation, improving productivity, and enhancing employee engagement:

- Increased Productivity: Companies with high ESG scores see 13% higher employee productivity. Higher ESG ratings also translate into increased productivity. Research from Gallup shows that companies with high ESG scores see 13% higher employee productivity.

- Improved Employee Engagement: ESG initiatives have a positive impact on employee engagement, with companies reporting 14% higher productivity and 23% more profitability. ESG efforts go beyond corporate responsibility — they’re a potent tool for boosting employee engagement, attracting top talent, and winning over consumers.

- Enhanced Collaboration: When employees see that their company is making a positive environmental impact, it improves motivation, increases productivity, and enhances collaboration. Research also shows that when employees see that their company is making a positive environmental impact, it can Improve motivation, Increase productivity and Enhance collaboration.

Q: What is the role of ESG strategy training in maximizing sustainability training ROI?

A: ESG strategy training provides a structured, data-driven approach to ESG planning, ensuring that companies avoid common mistakes and unlock the full benefits of their sustainability initiatives:

- Data-Driven Decision-Making: ESG strategy training helps companies track key metrics, such as energy consumption, raw material usage, and waste treatment, leading to reduced energy bills and cost reductions. Companies must track key metrics—such as energy consumption, raw material usage, and waste treatment that can eventually lead to reduced energy bills and cost reductions.

- Long-Term Value Creation: Investing in ESG frameworks contributes to improved profitability, reduced risks, and enhanced market positioning, leading to better long-term financial performance. By strengthening risk management, improving operational efficiency, and enhancing financial resilience, ESG reporting ultimately drives long-term value creation – often offsetting or even surpassing the initial investment in ESG.

- Competitive Advantage: Companies with a well-defined ESG strategy gain a competitive edge, attracting investors, customers, and employees who prioritize sustainability. Companies with successful ESG programs can improve their market position and brand strength compared with competitors.

Connecting Themes: Weaving ESG into the Corporate Fabric

The questions above highlight how various facets of ESG training collectively enhance a company’s financial performance. From brand reputation to risk management and employee engagement, integrating ESG principles into every level of the organization can drive sustainable growth and profitability.

Supporting Resources & Examples: Practical ESG Implementation

- Nestlé’s Transition to Recycled Plastics: In 2020, Nestlé announced an investment of up to $2.1 billion by 2025 to transition to food-grade recycled plastics, reducing its carbon footprint and cutting compliance costs. This shift is expected to help Nestlé reduce its carbon footprint and cut compliance costs, especially in regions where there are stricter laws against the use of plastic packaging.

- Levi’s Sustainability Initiatives: Levi’s is embedding sustainability across climate, consumption, and community to drive business resilience and long-term value. Discover how Levi’s is embedding sustainability across climate, consumption, and community to drive business resilience and long-term value.

- Certified Sustainability Practitioner Program: Leadership Edition 2025: This program prepares leaders for the challenges ahead, providing the skills to integrate sustainability into their organizations. Ready to make a smart investment in your future? Explore the Certified Sustainability Practitioner Program: Leadership Edition 2025 and lead the change.

Conclusion & Key Takeaways: ESG Training as a Catalyst for Financial Success

In conclusion, ESG training is not merely a cost but a strategic investment with a high potential sustainability training ROI. By enhancing brand reputation, driving operational efficiency, attracting top talent, and improving financial performance, corporate ESG education can significantly boost a company’s bottom line. As consumers and investors increasingly prioritize sustainability, companies that invest in ESG training benefits will be best positioned for long-term success in 2025 and beyond. Companies that proactively integrate ESG into their business models enhance risk management, attract investment, and improve long-term profitability, ultimately strengthening financial returns, increasing shareholder value, and securing a competitive advantage in the market.

FAQs: Decoding ESG Training and its Impact

How does ESG training contribute to employee engagement?

ESG training enhances employee engagement by fostering a sense of purpose and aligning company values with employee values, leading to increased productivity and loyalty. The correlation between ESG and employee engagement is undeniable.

What is the ROI of investing in ESG certification courses for employees?

Investing in ESG certification courses improves employees’ skills, enhances the company’s sustainability efforts, attracts investors, and ultimately boosts financial performance. An ESG certification helps professionals to stand out in an ever-competitive job market.

Can ESG training help in attracting and retaining top talent?

Yes, companies with strong ESG strategies experience lower turnover among millennial employees and attract talent seeking purpose-driven work environments. Companies with strong ESG strategies experience 25% lower turnover among millennial employees, helping reduce recruitment costs and increase workforce stability

What are the key metrics to track the success of an ESG training program?

Key metrics include energy consumption, waste reduction, employee engagement, investor confidence, and overall financial performance. Companies must track key metrics—such as energy consumption, raw material usage, and waste treatment that can eventually lead to reduced energy bills and cost reductions.

How can small businesses benefit from ESG training?

Small businesses can benefit by reducing costs, enhancing brand reputation, attracting local customers, and aligning with community values through effective ESG practices. Whether you’re part of a small business or a multinational corporation, an ESG strategy can both increase value and reduce costs for your organization.

Quick Summary: Maximizing Your Company’s Bottom Line with ESG Training

Investing in ESG training offers multifaceted financial benefits for companies in 2025. By enhancing brand reputation, driving operational efficiency, and improving employee engagement, ESG initiatives significantly boost the bottom line. Leadership and employee education in ESG principles ensure strategic alignment and long-term value creation, positioning companies for sustained success in an increasingly sustainability-focused market.

Elevate your company’s ESG performance with ESGPro Mastery Institute. Specializing in ESG Due Diligence and ESG Transformation, we bridge the gap between sustainability theory and investment-grade performance. Let us help you improve your ESG scores and attract institutional investment.

Additional Resources:

3 Ways ESG Business Strategies Impact a Company’s Bottom Line

The ROI of Sustainability Training: Business & Professional…

ESG Strategy and Management Guide for Businesses | TechTarget

How to Use Your ESG Certification: Career Paths and Business…

Business case for ESG: How sustainability drives profit and…