- Understanding the Growing Importance of ESG Training Courses

- Exploring Top ESG Courses and ESG Certification Courses for 2025

- Integrating ESG into Your Career Path

- Navigating ESG Reporting and Standards

- Practical Applications and Real-World Examples of ESG

- Conclusion & Key Takeaways: Prioritizing ESG Training in 2025

- Frequently Asked Questions

Are you looking to enhance your career prospects and make a meaningful impact in 2025? Environmental, Social, and Governance (ESG) factors are becoming increasingly important in the business world, and possessing the right skills can significantly boost your professional journey. This guide explores the best ESG training and ESG certification courses available, helping you understand how these programs can equip you with the knowledge and expertise needed to excel in this rapidly growing field.

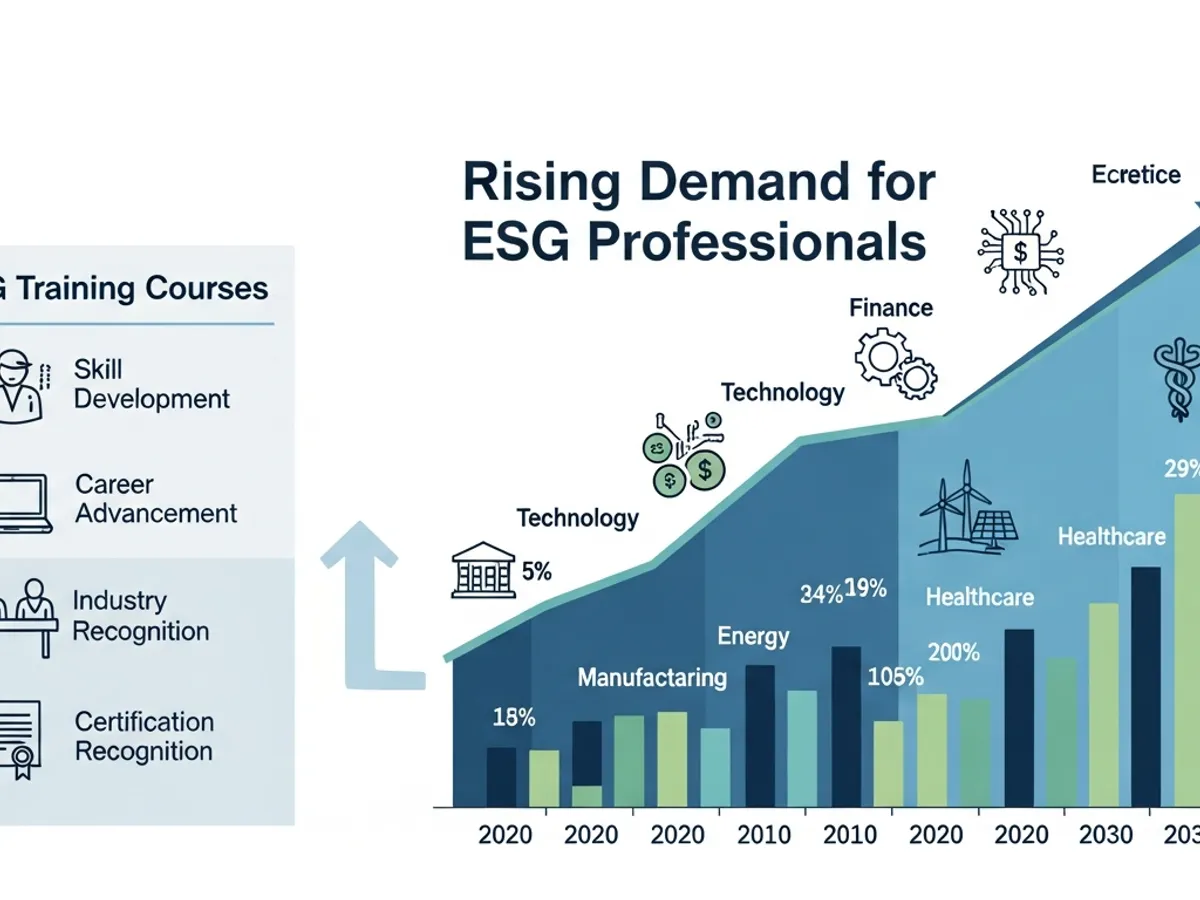

Understanding the Growing Importance of ESG Training Courses

Q: Why is ESG training increasingly important for career advancement in 2025?

A: As companies worldwide recognize the critical importance of sustainable practices, ESG has moved from a peripheral concern to a central business imperative. ESG courses and ESG training programs are essential for professionals who want to lead and implement these sustainable strategies effectively. These courses provide the necessary skills to integrate environmental, social, and governance criteria into organizational strategies, making ESG training a necessity for those aiming for leadership roles. Companies now understand that managing their sustainability data is not optional, so you need a ESG course. Measure, Interpret and Act on ESG information is already an essential part of staying competitive.

Q: What key skills and knowledge will I gain from ESG training?

A: An ESG investing course is designed to train professionals capable of integrating environmental, social, and governance criteria into the strategy of their organizations. ESG training equips you with skills in areas such as environmental impact assessment, social impact measurement, and governance frameworks. You will also learn about ESG reporting standards, sustainable finance, and ethical investment strategies. These skills enable you to develop sustainability strategies, improve stakeholder engagement, and manage ESG reporting effectively. ESG courses cover a variety of topics essential for understanding and implementing environmental, social, and governance principles in business practices.

Q: What are the benefits of obtaining an ESG certification?

A: Earning an ESG certification can significantly enhance your career prospects and opportunities for advancement in fields such as finance, corporate governance, and sustainability consulting. With ESG considerations creating new job opportunities, businesses seek qualified and certified candidates for ESG analysis, integration, risk and portfolio management, and more. A certificate in ESG investing, for instance, can position you among the top investment professionals. Getting certified is a clear signal to employers that you know how to combine profit with sustainability.

Exploring Top ESG Courses and ESG Certification Courses for 2025

Q: Which institutions offer some of the best ESG courses online in 2025?

A: Several leading institutions offer comprehensive ESG courses online. The Corporate Finance Institute (CFI) provides an Introduction to ESG course and an ESG Specialization. The University of Pennsylvania offers a course on ESG Risks and Opportunities, while the University of Cambridge provides a Sustainable Finance course. Additionally, the Wharton School offers an ESG Executive Certificate, and the Sustainability Academy provides an Online Certificate on ESG Reporting. Financial Edge also provides the Financial Edge ESG Certificate. For those beginning their journey, the ESG and Sustainable Investing Specialization on Coursera offers accessible, online, university-backed training. These courses vary in length and depth, allowing you to choose the one that best fits your learning style and career goals.

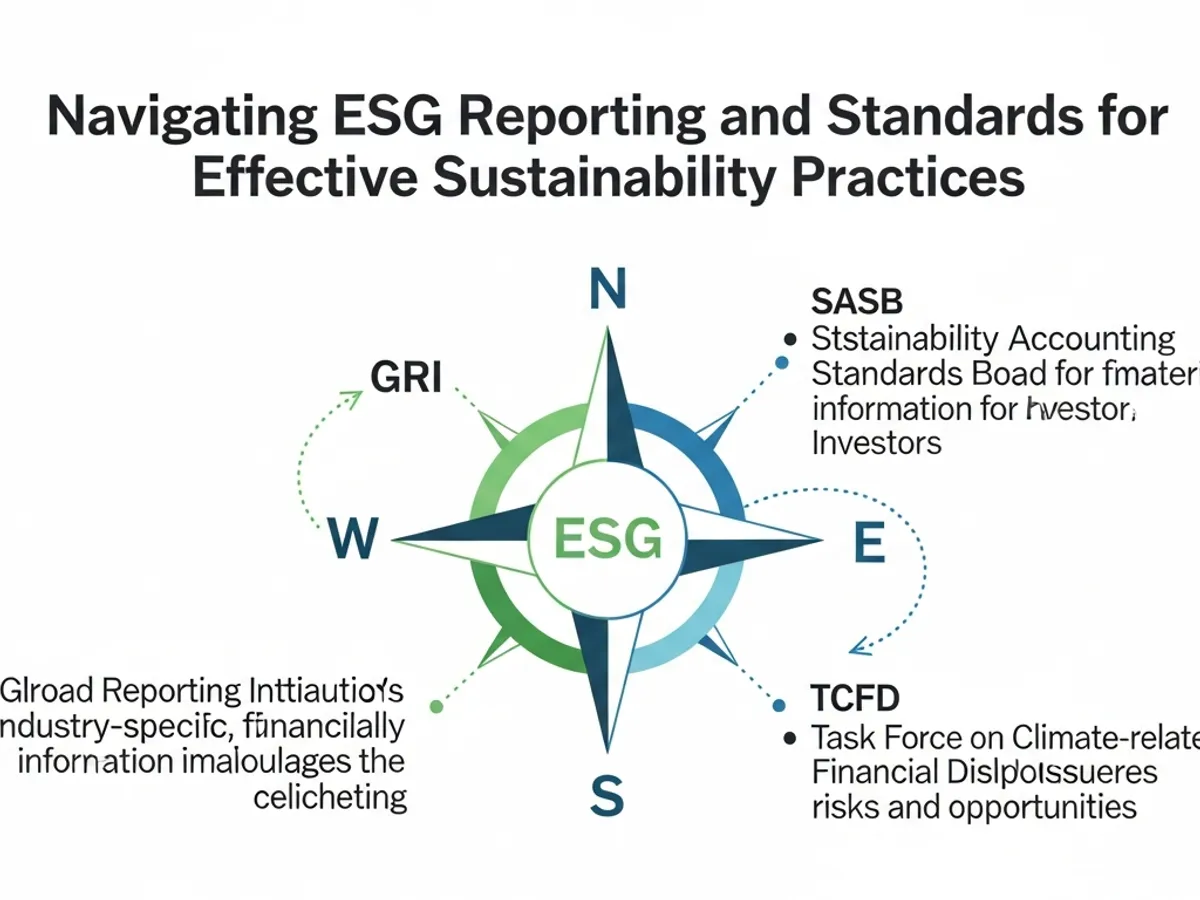

Q: What should I look for in an ESG reporting course?

A: An effective ESG reporting course should provide practical training to understand and apply the main reporting standards, such as GRI, SASB, and TCFD. The course should cover ESG data collection and presentation techniques, as well as how to structure effective reports for different stakeholders. The Online Certificate on ESG Reporting from the Sustainability Academy is specifically designed to train professionals in preparing high-quality ESG reports.

Q: What are some of the best ESG training programs for executives and board members?

A: For directors, executives, and board members, the Corporate Governance Institute ESG diploma stands out. Advanced executive diplomas, offered by institutions like Cambridge CISL and Wharton, go beyond compliance frameworks to focus on systems thinking, stakeholder governance, and ethical decision-making. The ESG Online Program – Driving Sustainable Transformation at WU Executive Academy offers a holistic approach to ESG principles and the necessary tools for implementing sustainability measures.

Integrating ESG into Your Career Path

Q: How can ESG training benefit my career in the long term?

A: ESG knowledge is in demand. By getting certified, you make yourself stand out in job markets. Companies value this expertise because it helps them navigate new regulations, investor demands, and consumer preferences. Whether you want to understand ESG reporting, integrate ESG into investment models, or simply build fluency in sustainability language, ESG training programs can help you take the next step fast.

Q: What types of roles are available for professionals with ESG certification?

A: Professionals with ESG certification can pursue various roles, including sustainability consultants, ESG analysts, portfolio managers, and corporate sustainability directors. As businesses increasingly prioritize sustainability, the demand for ESG specialists continues to grow. This trend creates numerous opportunities for those with the right ESG training and qualifications. For instance, sustainability consultants can earn between $60,000 and $110,000, while corporate sustainability directors can earn upwards of $120,000.

Q: How do I choose the right ESG certification program for my goals?

A: To choose the right ESG certification program, identify your goals and research reputable programs that align with them. Consider programs like AGRC’s training, the Global Reporting Initiative, or the CFA Institute‘s ESG Investing Certificate. Look for programs that offer a balance of theoretical knowledge and practical skills, and that are recognized by industry leaders. By honing in on these specific criteria, you can select an ESG certification program that meets your educational needs and propels you towards your long-term professional goals.

Navigating ESG Reporting and Standards

Q: What are the main ESG reporting frameworks I should be familiar with?

A: The main ESG reporting frameworks include the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). Each framework offers a unique approach to reporting ESG data, and understanding these frameworks is crucial for creating effective and transparent ESG reports. The GRI standards focus on a wide range of sustainability topics, while SASB standards are industry-specific and focus on financially material ESG factors. TCFD focuses specifically on climate-related risks and opportunities.

Q: How can I effectively manage an ESG report for my organization?

A: To effectively manage an ESG report, start by understanding the reporting requirements and key performance indicators (KPIs) relevant to your industry. Collect and present ESG data accurately, and structure your report to meet the needs of different stakeholders. Improve stakeholder engagement by communicating your organization’s ESG performance transparently. Obtain official certification issued directly by GRI to enhance the credibility of your report.

Q: What role does ESG data play in investment decisions?

A: ESG data plays a crucial role in investment decisions by providing insights into a company’s environmental, social, and governance performance. Investors use this data to assess risks and opportunities, and to make informed decisions about where to allocate capital. ESG integration involves the systematic and explicit inclusion of ESG factors into financial analysis of securities. This process helps investors identify companies that are well-positioned for long-term sustainable growth.

Practical Applications and Real-World Examples of ESG

Q: Can you provide real-world examples of companies benefiting from ESG implementation?

A: Many companies have successfully integrated ESG practices into their business models and achieved positive outcomes. For example, companies that prioritize environmental stewardship have reduced their carbon footprint and improved resource efficiency. Those that focus on social responsibility have enhanced their relationships with employees and communities. Strong corporate governance practices have led to improved transparency and accountability.

Q: How can ESG principles be applied in different industries?

A: ESG principles can be applied in various industries, including finance, manufacturing, and technology. In the finance industry, ESG principles guide investment decisions and promote sustainable finance. In manufacturing, ESG principles drive efforts to reduce waste and improve supply chain sustainability. In technology, ESG principles promote ethical data practices and responsible innovation.

Q: What are the key challenges in implementing ESG practices, and how can they be overcome?

A: Implementing ESG practices can present several challenges, including a lack of standardized metrics, difficulty in measuring social impact, and resistance to change. To overcome these challenges, organizations should adopt recognized reporting frameworks, invest in data collection and analysis, and engage stakeholders in the process. Effective change management strategies are essential for aligning sustainability with the company’s financial objectives.

Conclusion & Key Takeaways: Prioritizing ESG Training in 2025

In conclusion, ESG training is crucial for career advancement in 2025, as businesses worldwide increasingly prioritize sustainable practices. By obtaining the right ESG courses and ESG certification courses, you can equip yourself with the skills and knowledge needed to excel in this rapidly growing field. Whether you are an executive, a manager, or an aspiring professional, investing in ESG training can significantly enhance your career prospects and make a meaningful impact on the world. Embrace ESG principles, navigate reporting standards, and apply real-world examples to drive sustainable change within your organization. Start your ESG learning journey today to unlock new opportunities and contribute to a more sustainable future.

Frequently Asked Questions

Which ESG certification is the best for advancing my career?

The best ESG certification depends on your career goals. For investment professionals, the CFA Institute’s ESG Investing Certificate is highly regarded. For sustainability consultants, programs like the Certified Sustainability (ESG) Practitioner Program offered by CSE are excellent.

What skills will I gain from an ESG course?

You will gain skills in environmental impact assessment, social impact measurement, governance frameworks, ESG reporting standards, sustainable finance, and ethical investment strategies.

How can ESG training improve my company’s sustainability practices?

ESG training provides the knowledge and tools needed to integrate environmental, social, and governance criteria into your organization’s strategy, enhancing transparency, accountability, and overall sustainability performance.

What are the main ESG reporting frameworks to be familiar with?

The main ESG reporting frameworks include the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD).

Where can I find the best ESG courses online?

Leading institutions like the Corporate Finance Institute (CFI), University of Pennsylvania, University of Cambridge, Wharton School, and Sustainability Academy offer excellent ESG courses online.

At ESGPro Mastery Institute, we are dedicated to bridging the gap between sustainability theory and investment-grade performance. Explore our ESG certification and advisory services to enhance your ESG expertise and drive long-term value.

Additional Resources

- Best ESG courses – Institute for Sustainable Innovation

- ESG certification – Earth5R

- Short ESG Courses – Financial Edge Training

- ESG Programs – Coursera Learn Online

- ESG Investing – Columbia Business School

- ESG Qualification – The Corporate Governance Institute

- ESG training course – ESGPro Mastery Institute

- ESG training – ESGPro Mastery Institute

- ESG training 2025 – ESGPro Mastery Institute

- ESG reporting frameworks – ESGPro Mastery Institute

- ESG training benefits – ESGPro Mastery Institute