- Navigating ESG Compliance: Why Business Readiness is Crucial in 2025

- Q&A: Essential Insights into ESG Compliance for 2025

- The Impact of ESG on Business Operations: Key Considerations

- Real-World Examples and Tools for ESG Compliance

- Future-Proofing Your Business: Preparing for Evolving ESG Demands

- Conclusion: Achieving Sustainable Business Success Through ESG Compliance

- FAQs: Addressing Common Questions About ESG Compliance

Navigating ESG Compliance: Why Business Readiness is Crucial in 2025

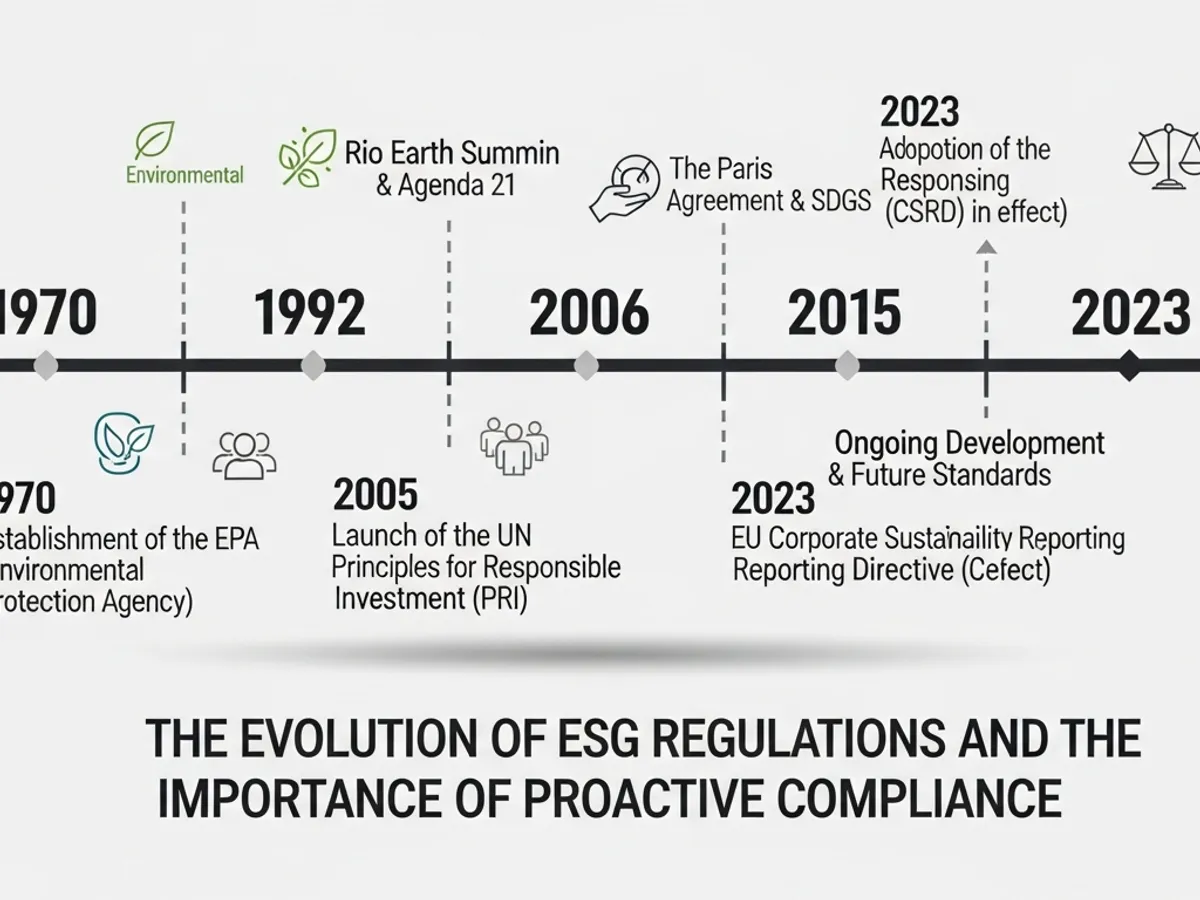

As 2025 approaches, companies face increasingly stringent ESG compliance demands, necessitating a proactive and comprehensive approach to regulatory compliance. Understanding and adapting to these evolving ESG compliance standards is crucial for maintaining a competitive edge and ensuring long-term sustainability. Are you prepared for the challenges ahead? Let’s explore key aspects of ESG compliance and what it means for your business readiness.

Q&A: Essential Insights into ESG Compliance for 2025

Q: What exactly does ESG compliance mean for my company in 2025?

A: ESG compliance refers to your company’s adherence to laws, regulations, and industry standards related to sustainability and ethical business practices. It encompasses environmental protection efforts, social responsibility, and corporate governance policies that align with ESG regulatory compliance and stakeholder expectations. Meeting these demands is no longer optional but a critical factor in corporate sustainability, investor confidence, and regulatory adherence. ESG legal compliance is paramount to avoiding legal penalties, supply chain disruptions, and loss of market access. Companies should focus on preparing for ESG compliance in 2025 by integrating regulatory requirements into broader sustainability strategies and strengthening governance and data management. This proactive approach helps your company meet legal standards and demonstrates your commitment to ethical and sustainable operations.

Q: What are the key areas of focus for ESG regulatory compliance?

A: ESG regulatory compliance spans several critical areas, including:

- Environmental Impact: Reducing carbon emissions, managing waste, conserving resources, and adhering to environmental regulations.

- Social Responsibility: Ensuring fair labor practices, promoting diversity and inclusion, protecting human rights, and engaging with local communities.

- Corporate Governance: Maintaining transparency, ensuring ethical leadership, implementing robust risk management practices, and protecting shareholder rights.

Q: How do ESG compliance standards vary across different regions?

A: The ESG regulatory compliance landscape is increasingly fragmented, with varying regulations across different regions. For instance, the EU’s Corporate Sustainability Reporting Directive (CSRD) requires companies to disclose detailed ESG information, while the U.S. Securities and Exchange Commission (SEC) has introduced rules on climate-related disclosures for public companies. Organizations must conduct rigorous assessments of their regulatory requirements across different regions, especially in the EU, where different countries may adopt different transposing laws for CSRD regulation. US companies face significant hurdles in preparing for international ESG regulations, including internal capacity constraints, team coordination, data collection and assurance, double materiality assessments, and disclosure strategy.

Q: What steps should my company take to ensure ESG compliance readiness?

A: To ensure business readiness for ESG compliance, consider the following steps:

- Conduct an ESG Risk Assessment: Identify potential ESG risks and opportunities relevant to your business.

- Set Clear ESG Goals and Targets: Align your business priorities with mandatory deadlines for ESG requirements by setting specific, measurable targets.

- Implement an ESG Compliance Framework: Establish a structured approach that integrates risk management, data collection, governance, and supplier oversight.

- Leverage Technology Solutions: Invest in ESG compliance solutions that automate reporting, track regulatory changes, and improve efficiency.

- Engage Stakeholders: Communicate transparently with investors, employees, customers, and communities about your ESG efforts.

Q: What role does ESG compliance software play in meeting regulatory demands?

A: ESG compliance solutions are crucial for streamlining ESG efforts by automating reporting, tracking regulatory changes, and improving efficiency. These tools enable companies to monitor ESG performance, manage obligations, and ensure accurate data collection. Investing in the right software helps businesses enhance their ESG performance, mitigate risks, and gain a competitive edge. These systems offer functionalities like benchmarking and visualization for internal and external reporting.

Q: How can my company manage and monitor supplier ESG performance?

A: Managing supplier ESG performance is essential for ensuring ESG compliance throughout your supply chain. This involves:

- Assessing Supplier ESG Performance: Use advanced evaluation tools, digital platforms, and real-time data to monitor supplier practices.

- Integrating ESG Best Practices: Incorporate ESG principles into procurement, sourcing, and logistics processes.

- Navigating Global ESG Regulations: Stay informed about global standards such as GRI, SASB, TCFD, and emerging digital compliance frameworks.

Q: What are the potential risks of non-compliance with ESG regulations?

A: Non-compliance with ESG regulations can lead to significant risks, including:

- Financial Penalties: Facing fines and legal action for failing to meet regulatory requirements.

- Reputational Damage: Losing credibility with investors, customers, and stakeholders due to unethical or unsustainable practices.

- Loss of Market Access: Experiencing supply chain disruptions and reduced access to capital and market opportunities.

The Impact of ESG on Business Operations: Key Considerations

Integrating ESG into Compliance Risk Assessment

ESG factors are rapidly becoming central to compliance risk assessment, as regulators worldwide implement new reporting requirements and stakeholders increasingly demand sustainable business practices. Companies should consider impacts on diverse stakeholder groups, including employees, communities, customers, investors, and regulators. ESG compliance risks should be prioritized based on materiality assessments that consider both stakeholder importance and business impact. ESG reporting and adherence to global sustainability standards is crucial for credibility.

Key ESG Compliance Risk Categories

- Environmental Compliance Risks: Climate disclosure requirements, environmental impact assessments, waste management, and supply chain environmental compliance.

- Social Compliance Risks: Labor rights, diversity and inclusion, health and safety, and community engagement.

- Governance Compliance Risks: Ethical leadership, transparency, risk management, and shareholder rights.

Leveraging Technology for Enhanced ESG Compliance

By incorporating AI and ESG integration, businesses can monitor regulatory amendments and measure themselves against changing benchmarks. AI-based tools handle the collection and integration of various ESG indicators from different sources, reducing human labor and improving data accuracy. VisionX Technologies, Inc. specializes in helping businesses navigate the complexities of ESG compliance with advanced solutions.

Real-World Examples and Tools for ESG Compliance

- EcoVadis: Provides trusted ESG ratings, supplier risk mapping, and AI-driven analytics to help meet global regulations.

- Compliance & Risks’ ESG Solution: Helps seamlessly implement a company-wide ESG strategy by providing an overview of mandatory reporting obligations and mapping these to ESG goals.

- iTech, an IBM OpenPages partner: Specializes in helping businesses navigate the complexities of ESG compliance and achieve their ESG goals.

- Unilever: A company that publishes its reports according to WEF IBC, GRI, SASB and the UN Global Compact, demonstrating a commitment to ESG principles.

Future-Proofing Your Business: Preparing for Evolving ESG Demands

The Role of AI in ESG Reporting and Compliance

AI plays a crucial role in improving corporate ESG compliance by automating data collection, enhancing data accuracy, and providing predictive risk assessment for sustainability. ESG AI systems uncover discrepancies, authenticate figures, and bring to attention possible compliance troubles that could turn into risks. This ensures that ESG reports are credible, auditable, and compliant with industry standards. Mastering ESG reporting is key to sustainable business success.

Staying Ahead of Regulatory Changes

Proactive ESG compliance measures can enhance a company’s ability to adapt to future regulatory changes. Key activities include identifying potential ESG risks, developing a strategy, and gathering relevant data. Monitoring regulatory changes for ESG obligations is crucial for ensuring ‘Zero ESG Surprises’.

Conclusion: Achieving Sustainable Business Success Through ESG Compliance

In conclusion, meeting 2025’s toughest ESG compliance demands requires a strategic, proactive, and technology-driven approach. By understanding the key areas of regulatory compliance, setting clear ESG goals, implementing a robust compliance framework, and leveraging innovative solutions, your company can not only mitigate risks but also drive long-term value creation and sustainable business success. Business readiness for ESG compliance is not just a regulatory necessity; it’s a business imperative that ensures your company remains competitive, responsible, and resilient in a rapidly evolving world. Remember, ESG compliance is an ongoing journey that requires continuous adaptation and a commitment to ethical and sustainable practices.

FAQs: Addressing Common Questions About ESG Compliance

What is the significance of ESG compliance for investors?

ESG compliance has become a crucial point for companies as they must meet the growing expectations of investors, employees, consumers, and regulators. Investors are increasingly integrating ESG factors into their decision-making processes to assess potential investments and gauge the risks and impacts associated with a company.

How can companies effectively monitor and report their ESG performance?

Companies can use ESG reporting software and tools to monitor their ESG performance and meet various obligations related to these issues. These tools allow monitoring the ESG performance of companies as well as the various obligations related to these issues.

What is the role of third-party audits in ESG compliance?

ESG compliance must be verified by an audit, most often external. This control process by third-party organizations to validate compliance is, for example, mandatory under the CSRD.

How does ESG compliance contribute to a company’s long-term sustainability?

ESG compliance ensures that companies adhere to environmental, social, and governance standards, promoting responsible and ethical practices. It leads to better risk management, increased operational efficiency, and enhanced stakeholder trust, all of which are essential for long-term sustainability.

What are the key challenges companies face in achieving ESG compliance?

Companies face challenges in data collection, interpretation, and reporting, as well as in aligning their business practices with evolving ESG standards. Other challenges includes internal capacity constraints, team coordination, data collection and assurance, double materiality assessments, and disclosure strategy.

What are the benefits of integrating digital technologies into ESG compliance?

Digital technologies including blockchain, IoT, AI, and big data analytics enhance ESG transparency, traceability, and reporting. AI and ESG integration helps businesses monitor regulatory amendments, measure themselves against changing benchmarks, and improve data accuracy.

How can companies ensure they are aligned with global ESG regulations and standards?

To align with global ESG regulations and standards, companies must proactively monitor regulatory changes, leverage technology to track obligations, and engage suppliers effectively. They should stay informed about global standards such as GRI, SASB, TCFD, and emerging digital compliance frameworks.

ESGPro Mastery Institute provides expert ESG certification and advisory services to help your company navigate the complexities of ESG compliance. Improve your ESG scores and attract institutional investment with our data-driven strategies. Visit us at ESGPro Mastery Institute.