- Introduction: Navigating ESG Reporting Frameworks for Business Growth in 2025

- Curated Q&A Sessions: Unlocking the Power of ESG Reporting Frameworks

- Connected Themes: Building a Cohesive ESG Strategy

- Supporting Resources & Examples

- Conclusion & Key Takeaways: Embracing ESG for Sustainable Growth

- Quick Summary

- FAQs

Introduction: Navigating ESG Reporting Frameworks for Business Growth in 2025

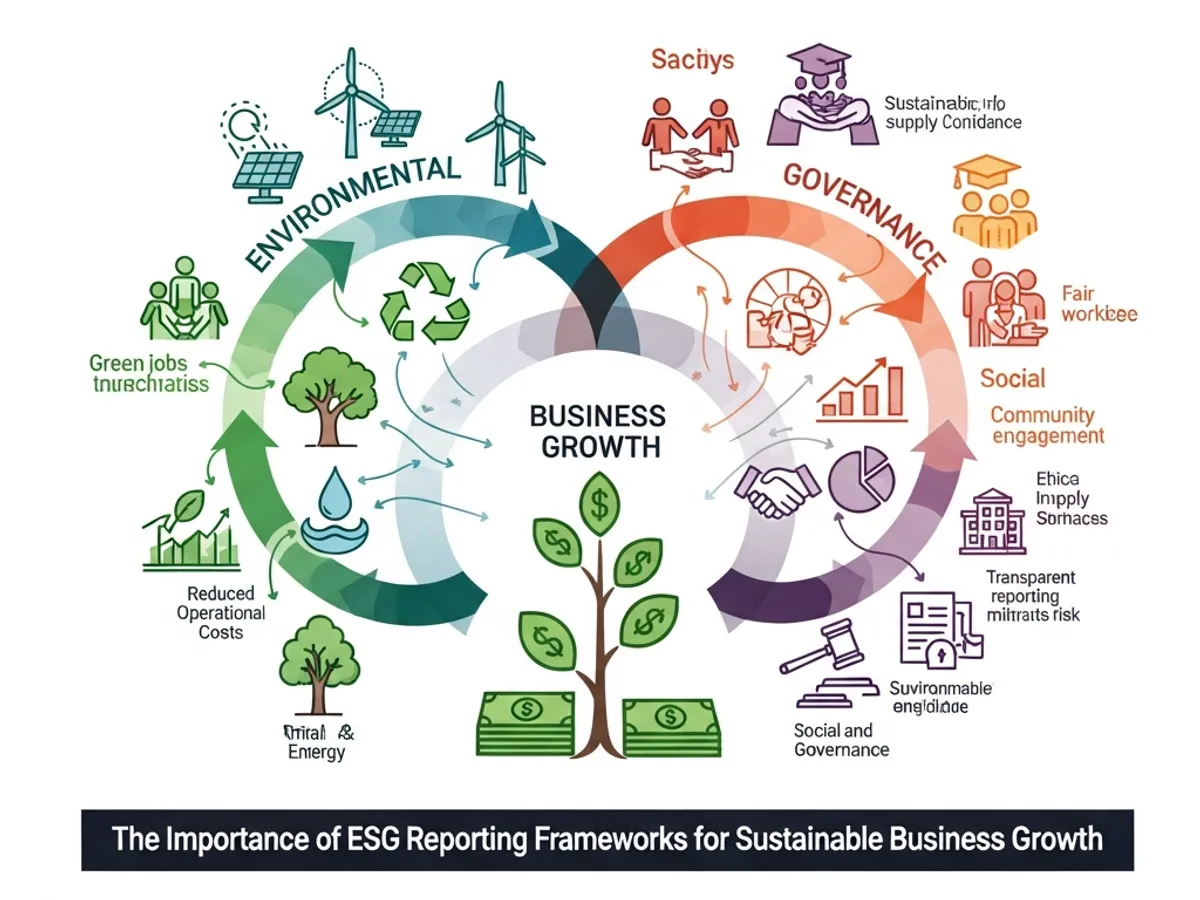

In 2025, Environmental, Social, and Governance (ESG) reporting is no longer a mere option but a critical component of business strategy. Investors, customers, employees, and regulators are increasingly demanding transparency in how companies manage their environmental impact, social responsibilities, and ethical practices. Understanding and effectively utilizing ESG reporting frameworks is essential for demonstrating your business’s commitment to sustainability, attracting socially conscious investors, and gaining a competitive edge in the evolving market. This guide explores how mastering ESG reporting frameworks can drive business growth 2025, turning compliance into a strategic advantage.

Curated Q&A Sessions: Unlocking the Power of ESG Reporting Frameworks

This section addresses key questions about ESG reporting frameworks, offering detailed insights to help businesses thrive in 2025.

Q: What are ESG reporting frameworks, and why are they crucial for business growth 2025?

A: ESG reporting frameworks are structured guidelines that help businesses measure, disclose, and improve their performance across environmental, social, and governance factors. These frameworks provide a roadmap for integrating sustainability into core business operations, aligning products and services with responsible practices.

- Strategic Roadmaps: ESG reporting frameworks guide businesses toward more sustainable and responsible practices, ensuring alignment with global standards.

- Measurable Improvement: These frameworks rely on ESG metrics, allowing organizations to measure and enhance their performance in critical areas like board diversity and greenhouse gas emissions.

- Stakeholder Trust: Effective ESG reporting fosters stronger stakeholder trust, enhances risk management, and creates long-term business value. To further enhance stakeholder trust, consider investing in corporate ESG education to ensure your team is well-versed in current best practices.

Q: Which ESG reporting frameworks should my business prioritize in 2025?

A: Prioritizing the right ESG reporting frameworks depends on your business’s specific needs, industry, and geographic location. However, several key frameworks are widely recognized and influential in 2025:

- Global Reporting Initiative (GRI): GRI standards focus on sustainability disclosures for all stakeholders, emphasizing transparency and comprehensive reporting. These disclosures ensure that your company’s sustainability efforts are well-documented and accessible.

- Sustainability Accounting Standards Board (SASB): SASB provides industry-specific ESG metrics for investors, offering a granular view of ESG risks and opportunities across different sectors. This helps investors assess your company’s performance against industry benchmarks.

- Task Force on Climate-related Financial Disclosures (TCFD): TCFD emphasizes climate risk disclosures in financial reporting, helping businesses assess and communicate their climate-related risks and opportunities. Addressing climate change is a vital aspect of corporate responsibility.

- International Sustainability Standards Board (ISSB): The ISSB’s IFRS S1 and S2 standards drive consistent and transparent sustainability reporting globally, aligning with global ESG expectations. Adherence to these standards is crucial for maintaining credibility in the international market.

- European Sustainability Reporting Standards (ESRS): ESRS, mandated by the Corporate Sustainability Reporting Directive (CSRD), requires detailed reporting on sustainability risks, impacts, and governance for companies operating in the EU. Compliance with ESRS is essential for companies doing business within the European Union. According to Thomson Reuters, the EU’s Corporate Sustainability Reporting Directive (CSRD) reporting deadline in early 2026 for multinationals and C-Suite decision-makers may help bring us closer to the day that sustainable practices are so commonplace in the corporate world that they’ll no longer need a separate label.

Q: How can my business integrate sustainability and financial reporting to enhance ESG performance?

A: Integrating sustainability and financial reporting is crucial for demonstrating how ESG efforts drive business resilience and long-term value creation. Leading companies are weaving ESG disclosures into their annual reports, showing that sustainability strategy is central to their overall business strategy.

- Comprehensive Reporting: Move beyond standalone sustainability reports by integrating ESG disclosures into annual reports. As noted by Nexio Projects, gone are the days of the standalone sustainability report. Today’s leading companies weave ESG disclosures into their annual reports, demonstrating how sustainability strategy is central to business strategy and long-term value creation.

- Strategic Alignment: Demonstrate how sustainability efforts drive business resilience and create opportunities for long-term value creation. Aligning your sustainability efforts with overall business goals ensures that ESG is not just a compliance issue, but a driver of business growth 2025.

- Transparency and Accountability: Show stakeholders how your sustainability initiatives contribute to financial performance and overall business success. This transparency builds trust and enhances your company’s reputation.

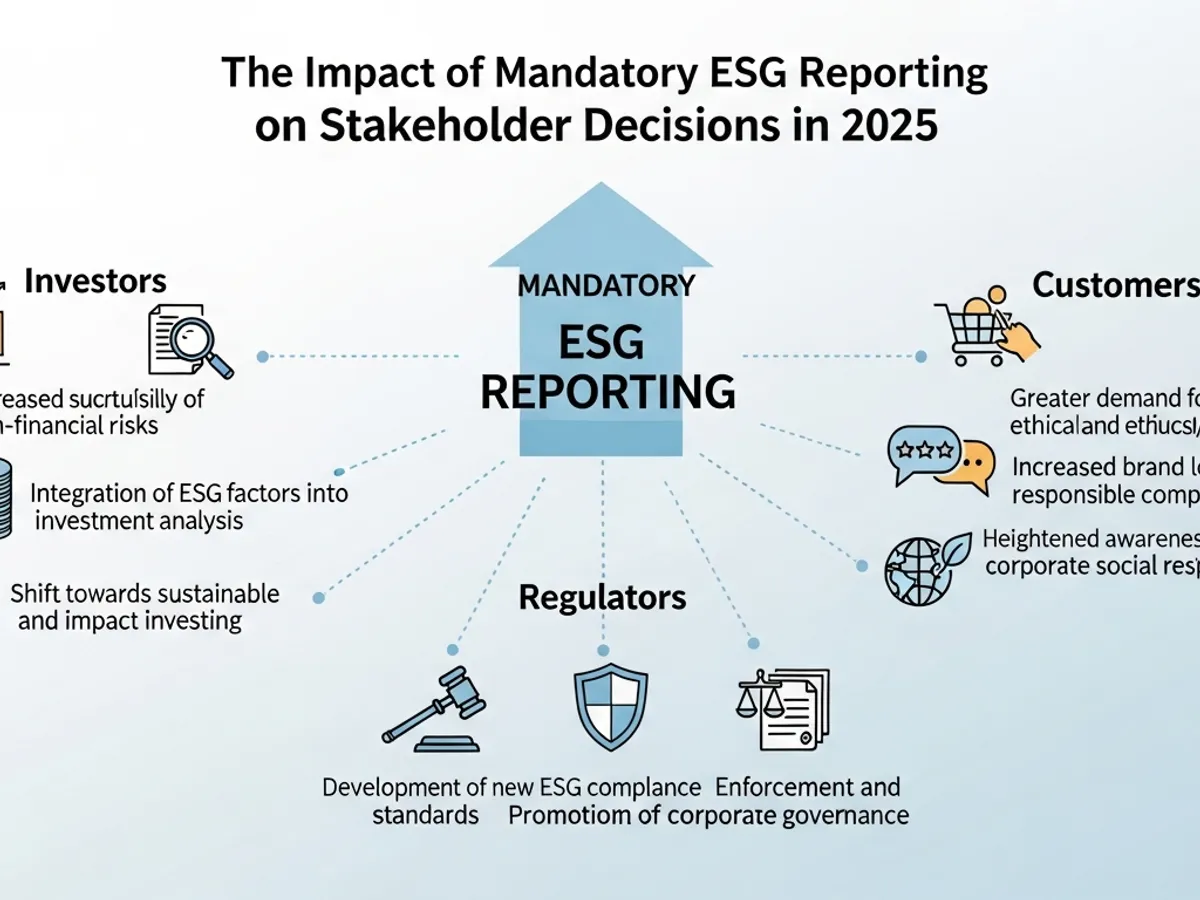

Q: What role does mandatory ESG reporting play in shaping stakeholder decisions in 2025?

A: Mandatory ESG reporting has become a critical factor in shaping stakeholder decisions. Investors, customers, and regulators expect standardized, auditable annual reports covering environmental, social, and governance performance.

- Investor Confidence: Strong ESG reporting enhances investor confidence, as they increasingly view ESG performance as integral to managing financial risk. As noted in a recent Workiva survey, 97% of C-Suite and other executives agreed that sustainability reporting creates value beyond compliance.

- Consumer Demand: As more consumers demand social responsibility, ESG reporting helps companies avoid greenwashing and demonstrate their commitment to sustainability. Using readily available ESG information that’s current, complete, and correct can help companies avoid greenwashing their environmental impact, according to Pulsora.

- Regulatory Compliance: Meeting mandatory ESG reporting requirements ensures ESG compliance, reduces the risk of penalties, and enhances a company’s reputation. Staying ahead of regulatory requirements is crucial for long-term success.

Q: How can technology and data management tools streamline ESG reporting and improve data quality?

A: Technology plays a crucial role in streamlining ESG reporting and ensuring data quality. Companies are increasingly investing in data management and ESG tracking tools to simplify sustainability management and gain a competitive edge. KEY ESG offers a platform that simplifies and enhances sustainability management, enabling leaders to make informed decisions and easily report under all relevant frameworks.

- Data-Driven Insights: Utilize technology to gather, analyze, and report ESG data efficiently and accurately. Vena’s State of Strategic Finance revealed that 75% of business leaders consider ESG criteria to be important or very important to their business strategy.

- Simplified Reporting: Employ platforms like KEY ESG to streamline the reporting process and ensure ESG compliance with various frameworks.

- Competitive Advantage: Leverage data-driven insights to identify areas for improvement and drive sustainable business strategy practices. This includes using such insights to get your company noticed for its sustainability reporting.

Q: How can businesses turn ESG compliance into a competitive advantage in 2025?

A: Treating ESG reporting as a strategic opportunity rather than just a compliance exercise can set businesses apart. By integrating reporting insights into business strategy, setting bold sustainability goals, and engaging stakeholders proactively, companies can shift from compliance to leadership.

- Strategic Integration: Integrate ESG considerations into core business operations and decision-making processes. This means embedding sustainability into every aspect of your business, from product development to supply chain management.

- Stakeholder Engagement: Proactively engage with stakeholders to understand their expectations and build trust. Regular communication and transparency are key to building strong relationships.

- Competitive Edge: Use ESG reporting to enhance your company’s reputation, attract socially conscious investors, and gain a competitive advantage. As stated by growthequityinterviewguide.com, companies with strong ESG performance can reduce operational costs (e.g., through energy efficiency), attract more investors, secure lower-cost financing, and enhance customer and employee loyalty.

Q: What are the key challenges in implementing ESG initiatives, and how can businesses overcome them?

A: Implementing ESG initiatives comes with its own set of challenges. These challenges range from knowing which metrics to report on, to scrutinizing data and recognizing their impact on the environment. Here are the ways businesses can overcome them:

- Prioritize Material Issues: Prioritize ESG impact toward more material business issues. According to Thomson Reuters, in 2025, businesses are expected to rigorously prioritize their ESG impact toward more material business issues.

- ESG as a strategic lens: Adopt ESG as a strategic lens and use it as an opportunity to fundamentally reshape their business models. An increasing number of companies are likely to adopt ESG as a strategic lens and use it as an opportunity to fundamentally reshape their business models.

- Data Driven Insights: Utilize technology to gather, analyze, and report ESG data efficiently and accurately. KEY ESG offers a platform that simplifies and enhances sustainability management. For leaders looking to make informed, sustainable decisions, gain a competitive edge, and easily report under all relevant frameworks, exploring KEY ESG’s solutions is a step in the right direction.

Connected Themes: Building a Cohesive ESG Strategy

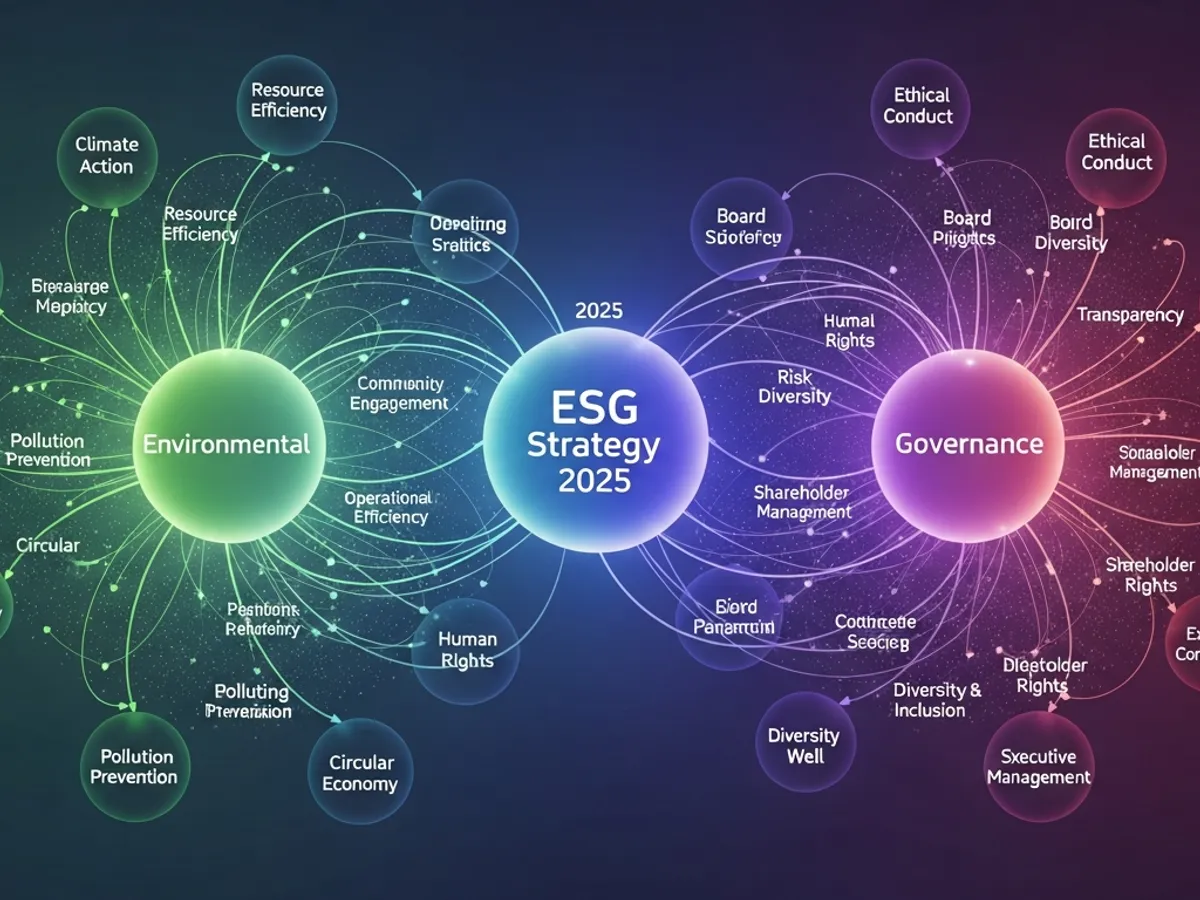

The questions above highlight several connected themes essential for building a cohesive ESG strategy in 2025:

- Integration of ESG into Core Business Strategy: ESG should move beyond compliance to become a core part of business strategy, influencing decision-making at all levels of the organization. To meet 2025’s toughest ESG compliance demands, companies need to take a strategic, proactive, technology-driven approach.

- Stakeholder Engagement: Engaging stakeholders is the heart of credible ESG reporting. Strong ESG reporting strengthens relationships across the value chain, building trust and enhancing access to capital. As noted by Pulsora, investors are more likely to engage with companies whose data is consistent and comparable.

- Data-Driven Decision Making: Leveraging technology and data management tools is crucial for streamlining ESG reporting and ensuring data quality.

Supporting Resources & Examples

Here are examples and resources to enhance your understanding and implementation of ESG reporting frameworks:

- Randstad: Randstad can help you meet ESG reporting requirements by providing your company with professionals who are experts in sustainability, regulatory compliance and ESG reporting frameworks.

- Nexio Projects: Download our 2025 sustainability reporting guide below or contact Nexio Projects for tailored support on your next report.

- PwC: Compelling sustainability reporting takes more than data – it requires alignment, insight and collaboration across your business.

- Anthesis: Anthesis’ regulatory and reporting experts share insights into expectations and their implications for businesses globally for 2025 and beyond.

Conclusion & Key Takeaways: Embracing ESG for Sustainable Growth

In conclusion, understanding and effectively utilizing ESG reporting frameworks is crucial for business growth 2025. By prioritizing the right frameworks, integrating sustainability into financial reporting, and leveraging technology to streamline data management, businesses can turn ESG compliance into a competitive advantage. Embrace ESG as a strategic opportunity to build stronger stakeholder trust, enhance risk management, and create long-term business strategy value. Companies like JPMorgan Chase (JPM), Wells Fargo (WFC), and Goldman Sachs (GS) publish annual reports that extensively review their ESG approaches and the bottom-line results.

Quick Summary

In 2025, ESG reporting has transitioned from a voluntary practice to a mandatory requirement for large enterprises, emphasizing transparency and accountability in environmental, social, and governance performance. Compliance with standardized, auditable data is essential for managing risk, satisfying investors, and maintaining stakeholder trust. Companies must prioritize integrating ESG into their core business strategy, leveraging technology for data management, and engaging stakeholders to drive sustainable growth. Embracing ESG reporting frameworks offers a competitive advantage, enabling businesses to demonstrate their commitment to sustainability, attract investors, and enhance their overall reputation.

FAQs

### Question: What are the primary benefits of adopting ESG reporting frameworks?

Answer: Adopting ESG reporting frameworks enhances transparency, reduces financial risks, strengthens corporate reputation, and attracts socially conscious investors, fostering sustainable business growth.

### Question: How does integrating ESG into core business strategies impact financial performance?

Answer: Integrating ESG into core business strategies can lead to reduced operational costs, improved brand reputation, better risk management, and enhanced customer and employee loyalty, positively impacting financial performance.

### Question: What role do stakeholders play in driving the adoption of ESG reporting?

Answer: Stakeholders, including investors, customers, employees, and regulators, demand transparency and accountability in ESG performance, driving companies to adopt robust reporting standards and sustainable business strategy practices.

### Question: Which global regulations should businesses be aware of in relation to ESG reporting in 2025?

Answer: Businesses should be aware of global regulations such as the EU’s Corporate Sustainability Reporting Directive (CSRD), the ISSB’s IFRS S1 and S2 standards, and climate disclosure rules in the US and Asia, which set the bar for transparency and accountability in ESG reporting.

### Question: How can small and medium-sized enterprises (SMEs) benefit from ESG reporting frameworks?

Answer: SMEs can leverage ESG reporting frameworks to improve operational efficiency, attract investors, build brand reputation, and gain a competitive advantage by demonstrating their commitment to sustainability and responsible business strategy practices.

ESGPro Mastery Institute helps companies improve their ESG scores, attract institutional investment, and build long-term enterprise value through data-driven strategies and compliance with global standards like GRI and BRSR. Learn more at ESGPro Mastery Institute.