The Corporate Sustainability Reporting Directive (CSRD) is set to transform how businesses in the European Union (EU) and beyond approach sustainability reporting. Effective from January 2026 for many organizations, the CSRD introduces stricter, more comprehensive ESG (Environmental, Social, and Governance) reporting requirements compared to its predecessor, the Non-Financial Reporting Directive (NFRD). With global implications and hefty penalties for non-compliance, preparing for CSRD is no longer optional—it’s a strategic imperative.

At ESG Pro Invest, we help businesses navigate complex ESG regulations and turn compliance into a competitive advantage. In this guide, we’ll break down the CSRD, its requirements, and a step-by-step plan to prepare your organization for 2026. Whether you’re a large corporation, an SME, or a non-EU company affected by the directive, this blog will equip you with the tools to succeed.

What is the CSRD?

The CSRD, adopted by the EU in November 2022, is a landmark regulation aimed at enhancing transparency in corporate sustainability performance. It expands the scope of the NFRD, requiring more companies to report detailed ESG data in a standardized, auditable format. The directive aligns with the EU’s Green Deal and the goal of achieving climate neutrality by 2050.

Key Features of the CSRD:

- Expanded Scope: Applies to approximately 50,000 companies, including large EU companies, listed SMEs, and non-EU companies with significant EU operations (e.g., €150 million in EU turnover and at least one subsidiary or branch).

- Standardized Reporting: Requires use of the European Sustainability Reporting Standards (ESRS), covering environmental, social, and governance topics.

- Double Materiality: Companies must report on how sustainability issues affect their business (financial materiality) and how their operations impact society and the environment (impact materiality).

- Third-Party Assurance: Reports must be audited for accuracy, increasing accountability.

- Digital Reporting: Disclosures must be tagged in a machine-readable format (XBRL) for integration into the European Single Access Point (ESAP).

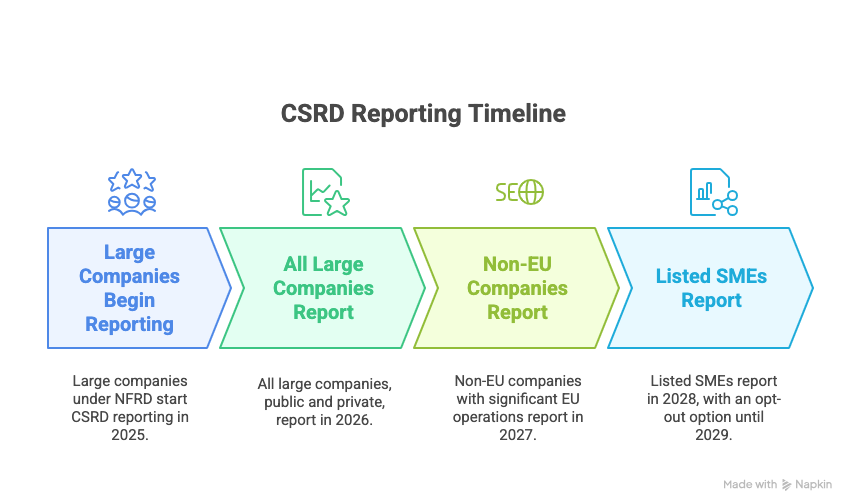

- Timeline: Reporting starts in 2025 for fiscal year 2024 for companies already under NFRD, with broader application in 2026 for fiscal year 2025 for other large companies and 2028 for listed SMEs.

Non-compliance risks fines, reputational damage, and restricted access to EU markets, making preparation critical.

Why Prepare for CSRD Now?

The CSRD’s complexity and data demands require significant lead time. Early preparation offers:

- Compliance Readiness: Avoid last-minute scrambles and penalties.

- Competitive Advantage: Showcase your sustainability leadership to investors and customers.

- Operational Efficiency: Streamline data collection and reporting processes.

- Investor Appeal: Meet the growing demand for ESG transparency, with $30 trillion in global ESG assets under management (as of 2023).

At ESG Pro Invest, we’ve helped clients across industries align with CSRD requirements. Our expertise ensures you’re not just compliant but positioned as a sustainability leader. Let’s dive into the steps to prepare.

Step-by-Step Guide to Prepare for CSRD in 2026

Step 1: Understand Your CSRD Obligations

Who’s Affected?

- Large Companies: EU companies (public or private) meeting two of three criteria: 250+ employees, €40 million net turnover, or €20 million in total assets.

- Listed SMEs: SMEs listed on EU-regulated markets (with lighter requirements starting in 2028).

- Non-EU Companies: Those with €150 million+ in EU turnover and at least one EU subsidiary or branch with €40 million turnover.

- Parent Companies: Must report on subsidiaries, including non-EU entities in consolidated reports.

Action Items:

- Review your company’s size, turnover, and EU presence to confirm applicability.

- Check if your subsidiaries or parent company trigger CSRD requirements.

- Consult with ESG experts (like ESG Pro Invest) to clarify your scope. Contact us for a free CSRD assessment.

Step 2: Conduct a Double Materiality Assessment

The CSRD requires a double materiality assessment to identify relevant ESG topics. This involves analyzing:

- Financial Materiality: How sustainability risks (e.g., climate change, labor issues) impact your financial performance.

- Impact Materiality: How your operations affect the environment, society, and governance (e.g., emissions, human rights, anti-corruption measures).

Action Items:

- Map stakeholders (e.g., investors, employees, suppliers) to understand their ESG priorities.

- Identify material topics using ESRS guidelines (e.g., climate change, biodiversity, diversity, governance).

- Use tools like GRI Standards or SASB Materiality Maps to align with industry-specific issues.

- Document findings in a materiality matrix to guide reporting.

Pro Tip: Our team at ESG Pro Invest specializes in materiality assessments, ensuring your CSRD report focuses on what matters most. Learn more about our services.

Step 3: Align with European Sustainability Reporting Standards (ESRS)

The ESRS provides a framework for CSRD reporting, covering:

- General Disclosures: Strategy, governance, and risk management related to ESG.

- Environmental Topics: Climate change, pollution, water, biodiversity, and resource use.

- Social Topics: Workforce conditions, diversity, human rights, and community impact.

- Governance Topics: Business ethics, anti-corruption, and board diversity.

Action Items:

- Review the 12 ESRS standards (available via the European Financial Reporting Advisory Group, EFRAG).

- Map existing data to ESRS requirements and identify gaps.

- Integrate ESRS with other frameworks (e.g., TCFD, GRI) to streamline reporting.

- Engage with sustainability consultants to interpret ESRS nuances.

Step 4: Build Robust Data Collection Systems

CSRD requires granular, auditable ESG data, often across your value chain (including Scope 3 emissions).

Action Items:

- Centralize Data: Create a data management system to collect ESG metrics (e.g., carbon emissions, employee diversity, supplier policies).

- Engage Your Value Chain: Collaborate with suppliers and partners to gather Scope 3 data (e.g., emissions from purchased goods).

- Leverage Technology: Use ESG software like Enablon, Sphera, or EcoVadis for data tracking and reporting.

- Train Teams: Educate finance, HR, and sustainability teams on CSRD data requirements.

Case Study: A manufacturing client of ESG Pro Invest reduced Scope 3 emissions by 20% by implementing our tailored data collection framework. Discover how we can help you.

Step 5: Prepare for Third-Party Assurance

CSRD mandates limited assurance (and eventually reasonable assurance) by independent auditors to verify report accuracy.

Action Items:

- Select an accredited auditor familiar with ESRS and CSRD.

- Conduct internal audits to ensure data quality before external review.

- Document methodologies for data collection to simplify assurance.

- Address gaps early to avoid audit delays.

Pro Tip: Partner with ESG Pro Invest to pre-audit your ESG data, ensuring a smooth assurance process. Schedule a consultation.

Step 6: Integrate CSRD into Business Strategy

Compliance is just the start—use CSRD to drive business value.

Action Items:

- Align ESG goals with corporate strategy (e.g., set science-based targets via SBTi).

- Communicate CSRD efforts to investors to attract ESG-focused capital ($480 billion in ESG funds in 2023).

- Use sustainability insights to innovate products, reduce costs, or enter new markets.

- Engage employees with training on sustainability’s role in your business.

Example: A retail client of ESG Pro Invest integrated CSRD data into their strategy, boosting investor confidence and securing a €10 million ESG-linked loan. See our success stories.

Step 7: Develop a CSRD-Compliant Report

Your CSRD report must be included in your annual management report, using ESRS standards and digital tagging.

Action Items:

- Draft a report covering all required ESRS disclosures (general, environmental, social, governance).

- Use clear visuals (e.g., charts, infographics) to present data.

- Ensure digital tagging in XBRL format for ESAP submission.

- Publish the report in your management report and on your website.

Pro Tip: Download our free CSRD Reporting Checklist at esgproinvest.com/resources to streamline your report.

Step 8: Engage Stakeholders and Communicate Transparently

Transparency builds trust with investors, customers, and regulators.

Action Items:

- Share CSRD progress on platforms like X, LinkedIn, and your website. Example: “We’re CSRD-ready! Learn how we’re reducing emissions at [esgproinvest.com]. #CSRD #Sustainability”

- Host webinars or X Spaces to discuss your ESG journey.

- Respond to stakeholder feedback to refine your approach.

Common Challenges and How to Overcome Them

- Data Gaps: Many companies lack comprehensive ESG data, especially for Scope 3.

- Solution: Start with proxy data or industry benchmarks and refine over time.

- Resource Constraints: SMEs may struggle with reporting costs.

- Solution: Partner with affordable consultants like ESG Pro Invest to optimize resources.

- Complexity of ESRS: The standards are detailed and technical.

- Solution: Work with experts to interpret and apply ESRS correctly.

- Value Chain Engagement: Suppliers may resist sharing data.

- Solution: Build partnerships and incentivize data sharing through contracts or sustainability programs.

Why Partner with ESG Pro Invest?

Preparing for CSRD is a complex but rewarding journey. At ESG Pro Invest, we offer:

- Tailored CSRD Consulting: From materiality assessments to ESRS alignment.

- Data Management Solutions: Tools and processes to collect auditable ESG data.

- Affordable Expertise: High-quality services for businesses of all sizes.

- Proven Results: Our clients have achieved compliance, reduced emissions, and attracted ESG investments.

Don’t wait until 2026—start your CSRD journey today. Download our free CSRD Guide or book a free consultation to learn how we can help.

Conclusion

The CSRD is a game-changer for sustainability reporting, offering businesses an opportunity to lead in the global shift toward transparency and accountability. By starting now, you can turn compliance into a strategic advantage, attracting investors, customers, and talent who value sustainability.

At ESG Pro Invest, we’re here to guide you every step of the way. Visit esgproinvest.com to access free resources, explore our services, or connect with our team. Let’s make 2026 your year to shine in ESG excellence!

Follow us on X (@ESGPromastery) for the latest CSRD updates and sustainability insights. #CSRD #ESG #Sustainability