Introduction

The concept of double materiality has gained significant traction in recent years as companies increasingly recognize the importance of assessing both financial risks and broader stakeholder impacts. This approach ensures that businesses not only focus on their economic performance but also consider the wider implications of their operations on society and the environment.

What is Double Materiality?

Double materiality refers to the process of identifying and managing issues that are both financially material to the company and relevant to the interests of its stakeholders. This concept is rooted in the belief that a company’s long-term success is intertwined with its ability to create value for all parties involved, including shareholders, employees, customers, and the communities in which it operates.

Recent Developments

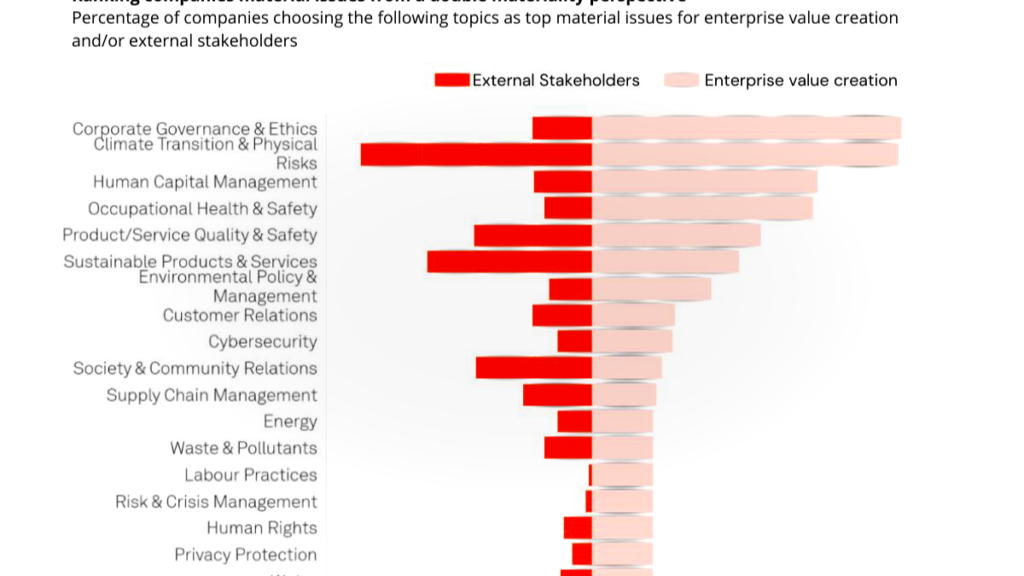

According to the S&P Global Corporate Sustainability Assessment 2024, while 4,592 companies identify material issues for enterprise value, less than half (1,902) report on external stakeholder impacts. This indicates that while many companies are aware of the importance of material issues, the practice of considering external impacts is still evolving.

Key Material Issues

The assessment highlights several key material issues that companies are focusing on. These issues are categorized into two main perspectives: enterprise value creation and external stakeholders.

Enterprise Value Creation

For enterprise value creation, the top material issues identified by companies include:

- Corporate Governance & Ethics: Ensuring ethical business practices and strong governance structures.

- Climate Transition & Physical Risks: Managing the risks associated with climate change and its physical impacts.

- Human Capital Management: Effectively managing and developing human resources.

- Occupational Health & Safety: Protecting the health and safety of employees.

- Product/Service Quality & Safety: Ensuring high-quality and safe products and services.

External Stakeholders

From the perspective of external stakeholders, the top issues are:

- Climate Transition & Physical Risks: The transition to a low-carbon economy and the physical impacts of climate change.

- Society & Community Relations: Building and maintaining positive relationships with communities.

- Sustainable Products & Services: Offering products and services that are environmentally sustainable.

- Environmental Policy & Management: Implementing effective environmental policies and management practices.

Overlap and Climate Risks

A notable overlap in these issues is climate risks, which affect both financial performance and environmental impact. For instance, data centers face rising operational costs due to extreme weather threats, highlighting the financial implications of climate change.

The Way Forward

With regulations tightening and investor expectations rising, companies must bridge the gap between financial and external materiality to drive meaningful sustainability progress. This involves integrating sustainability into core business strategies and operations, ensuring that decisions are made with a comprehensive view of both financial and non-financial impacts.

Conclusion

The adoption of double materiality is crucial for companies aiming to achieve long-term success in an increasingly complex and interconnected world. By considering both financial risks and stakeholder impacts, companies can create more resilient business models that contribute positively to society and the environment.

References

- S&P Global Corporate Sustainability Assessment 2024

This approach not only helps companies mitigate risks but also opens up opportunities for innovation and growth by addressing the needs and concerns of a broader range of stakeholders. As more companies embrace double materiality, we can expect to see a shift towards more sustainable and responsible business practices across the board.